r&d tax credit calculation example uk

Get a detailed RD calculations to your. Total Expenditure 13 3022500.

R D Tax Credits Explained How To Claim And Who Is Eligible

The rate of relief is.

. Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors. Direct RDs Claim Process Saves You 4000 - 8000 Based on the Avg. RD Tax Credit Explained 2021 Tax Credits Calculation with Free Calculator Check Your Eligibility.

Corporation Tax prior to RD Tax Credits Claim. Please provide a valid how much have you invested in rd over the last year. Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors.

The calculation shows how this affects a profitable company. Ad Submit HMRC RD Tax Credit Claims via Direct RD. SME RD tax credit calculations - Detailed Example Step 1.

How to Calculate RD Tax Credit for SMEs. R. Calculating RD relief for an SME depends on whether your business is profit- or loss-making.

You could receive up to 000 in. SME Claim of 41k. Ad Submit HMRC RD Tax Credit Claims via Direct RD.

Maximise your R. Ad Our sector specialists can maximise your RD claim. The rate at which businesses calculate their RD tax credit depends on.

Ad Our sector specialists can maximise your RD claim. SMEs are able to claim up to 33p for every 1 spent on qualifying RD activities. The average claim made by SMEs in the UK is 57228 2018-19.

SME RD relief allows companies to. Calculate RD tax relief in under 3 minutes. Estimate RD tax relief for your business.

Direct RDs Claim Process Saves You 4000 - 8000 Based on the Avg. Staff Costs 10000000. Calculate the base amount by multiplying the average and the fixed base percentage Calculate 50 of the current taxable years QREs OR the greater of the base.

SME Claim of 41k. Now as appears from the above youve carried out RD activities and youve calculated the qualifying expenditure to be 100000. The next step is easy.

Loss after deduction of. Deduct an extra 130 of their qualifying costs from their yearly profit as well as the normal 100 deduction to make a total 230. Profit before rd 130000 rd enhanced deduction 100000 x 230 230000.

Consumable Costs 10000000. Youll therefore multiply this amount by 130 and. 49375 from corporation tax savings and the payable tax credit.

Comprehensive Hasty Service. Call today for your free review. RD tax credit rates.

Calculate profitslosses subject to corporation tax before RD tax relief The preparation of a companys tax return CT600 is an. How much have you invested in RD over the last year. Supports Profit and Loss making companies.

RD Tax Credits Whether youre new to RD. Call today for your free review. During the webinar our guest host Tyler Kem from Strike Tax Advisory.

Profitable and loss making large companies equaly can benefit both potentially obtaining a RD Credit of 97 of their RD spend. Comprehensive Hasty Service. Most companies in the UK that claim RD tax relief fit into the SME category.

For profit-making businesses RD tax credits reduce your Corporation Tax bill. The next step takes the current year expenditures of 95000 and subtracts the 40000 three-year. If the company spent 100000 on RD.

For accounting periods beginning on or after 1 April 2021 the payable RD tax credit that a loss-making SME can receive will be capped at 20000 plus three times the amount paid in respect. You take 50 or half of this amount which is 40000. RD Tax Credit Calculation Example Uk.

In total there would receive back 1975 of their RD costs. 100000 X 130 130000. Subcontractor Costs 5000000 65 3250000.

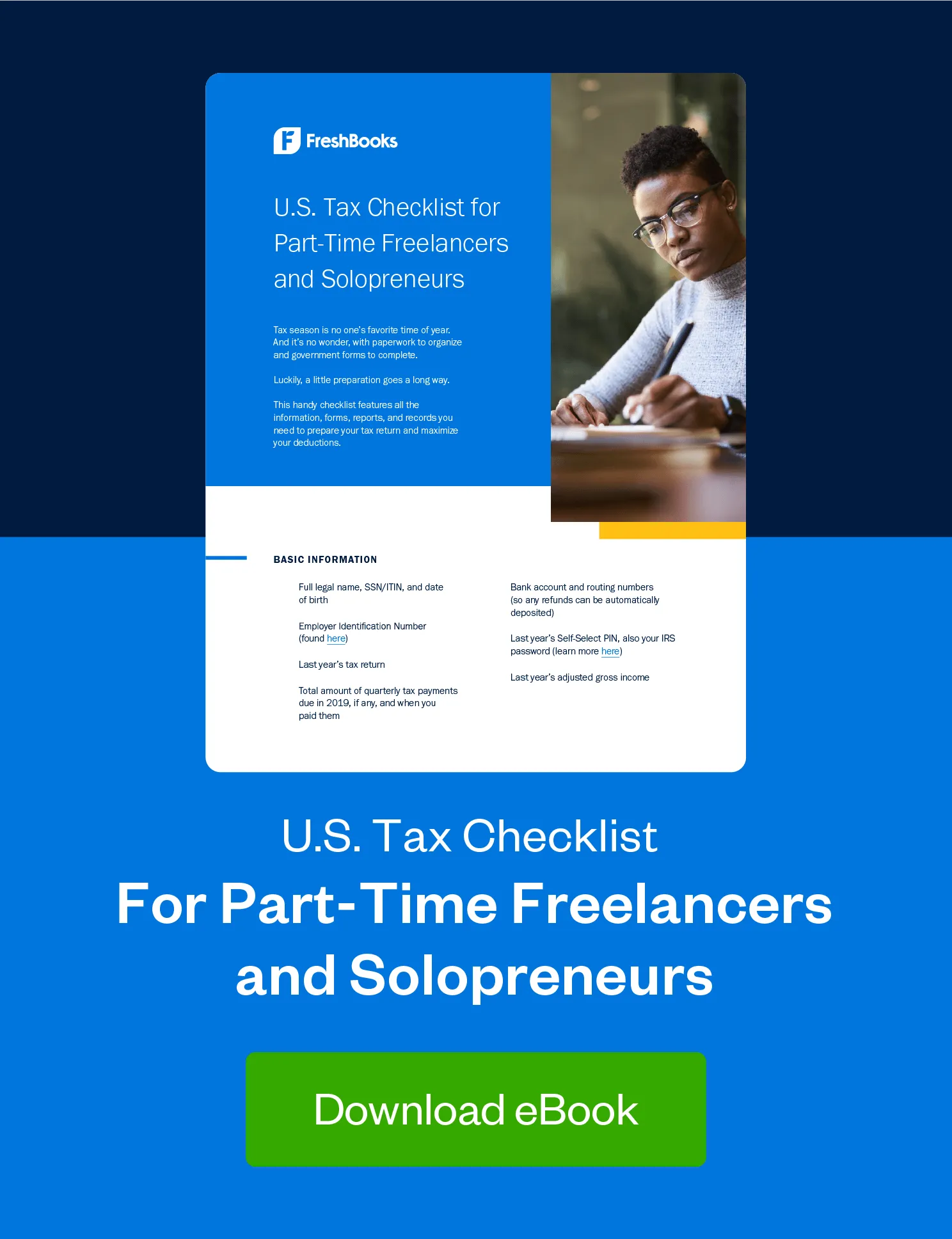

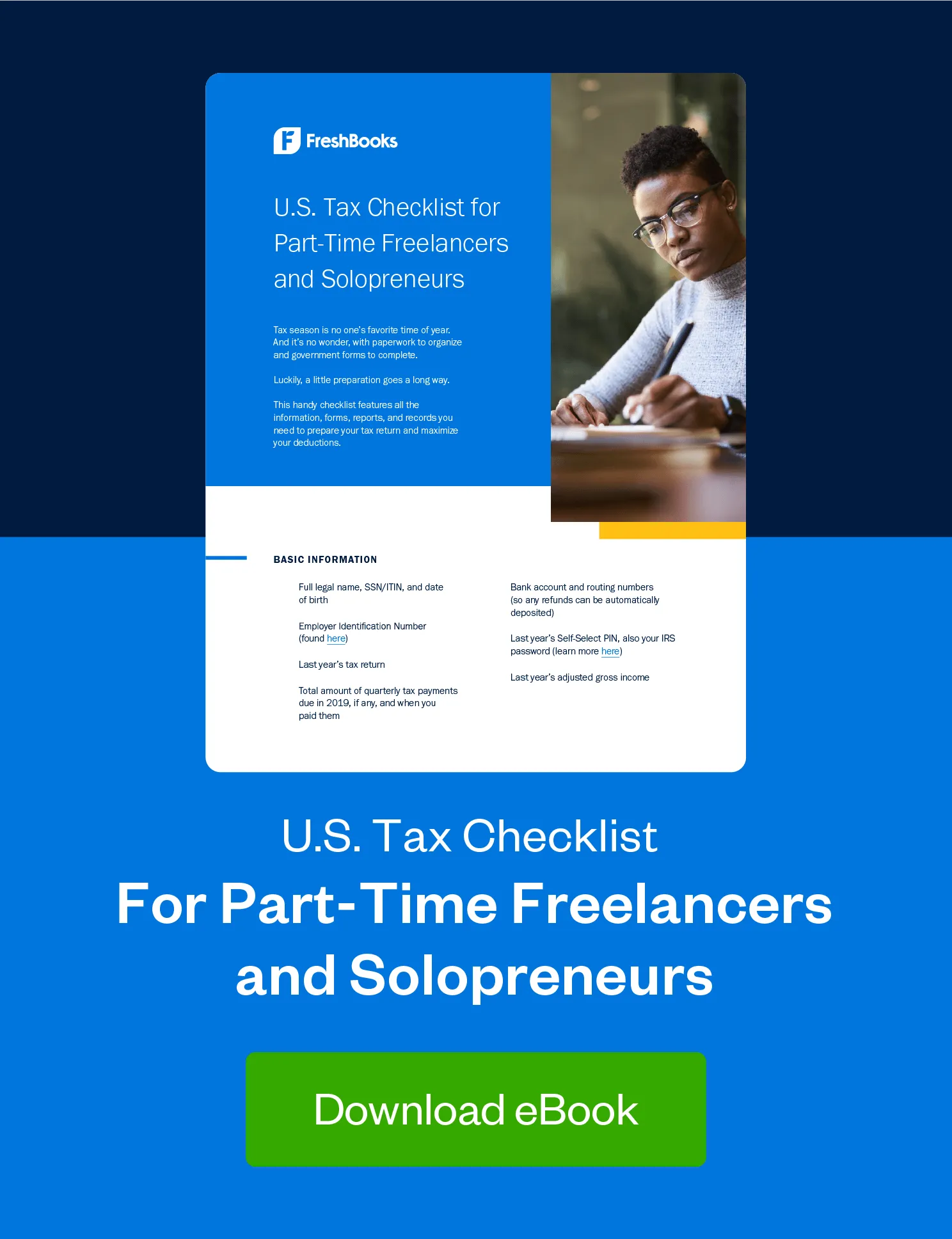

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

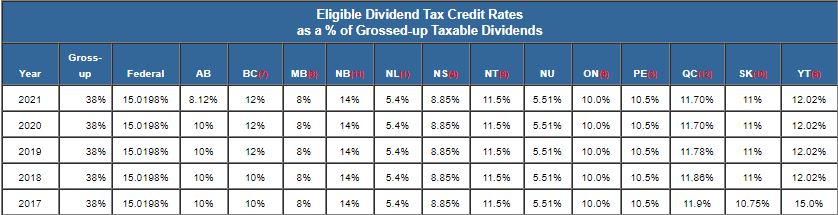

Taxtips Ca Dividend Tax Credit For Eligible Dividends

Understanding The R D Tax Credit A Guide For Tax Practitioners Advisors Youtube

7 Steps To Be A Successful Accountant Accounting Classes Apply For College Success

R D Tax Credit How Your Work Qualifies Alliantgroup

R D Tax Credits Explained How To Claim And Who Is Eligible

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

R D Tax Credit Calculation Methods Adp

Reforming The Earned Income Tax Credit And Additional Child Tax Credit To End Waste Fraud And Abuse And Strengthen Marriage The Heritage Foundation

6 Tax Credits And Deductions That Can Save Students And Their Parents A Bundle Globalnews Ca

Hydrogen Funding And Tax Credits Norton Rose Fulbright December 2021

Home Renovation Tax Credits In Canada Wowa Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

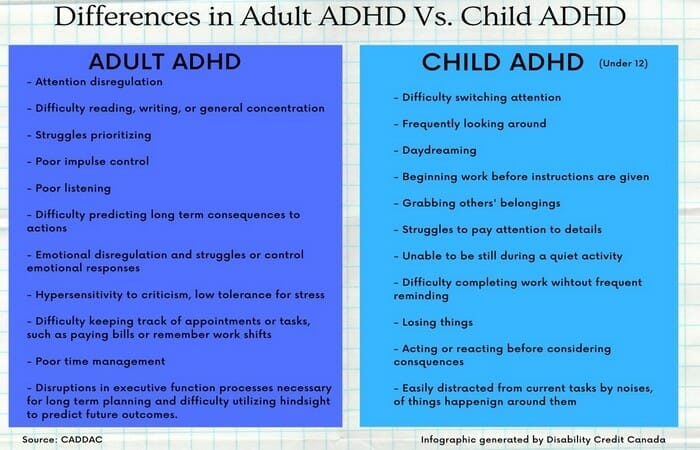

How Can You Qualify For Disability Tax Credits For Adhd Parental Guide

Taxtips Ca 2021 Non Refundable Personal Tax Credits Base Amounts

Taxtips Ca Ontario Non Refundable Lift Credit

Getting To Know Gilti A Guide For American Expat Entrepreneurs

.png)